child tax credit 2022 passed

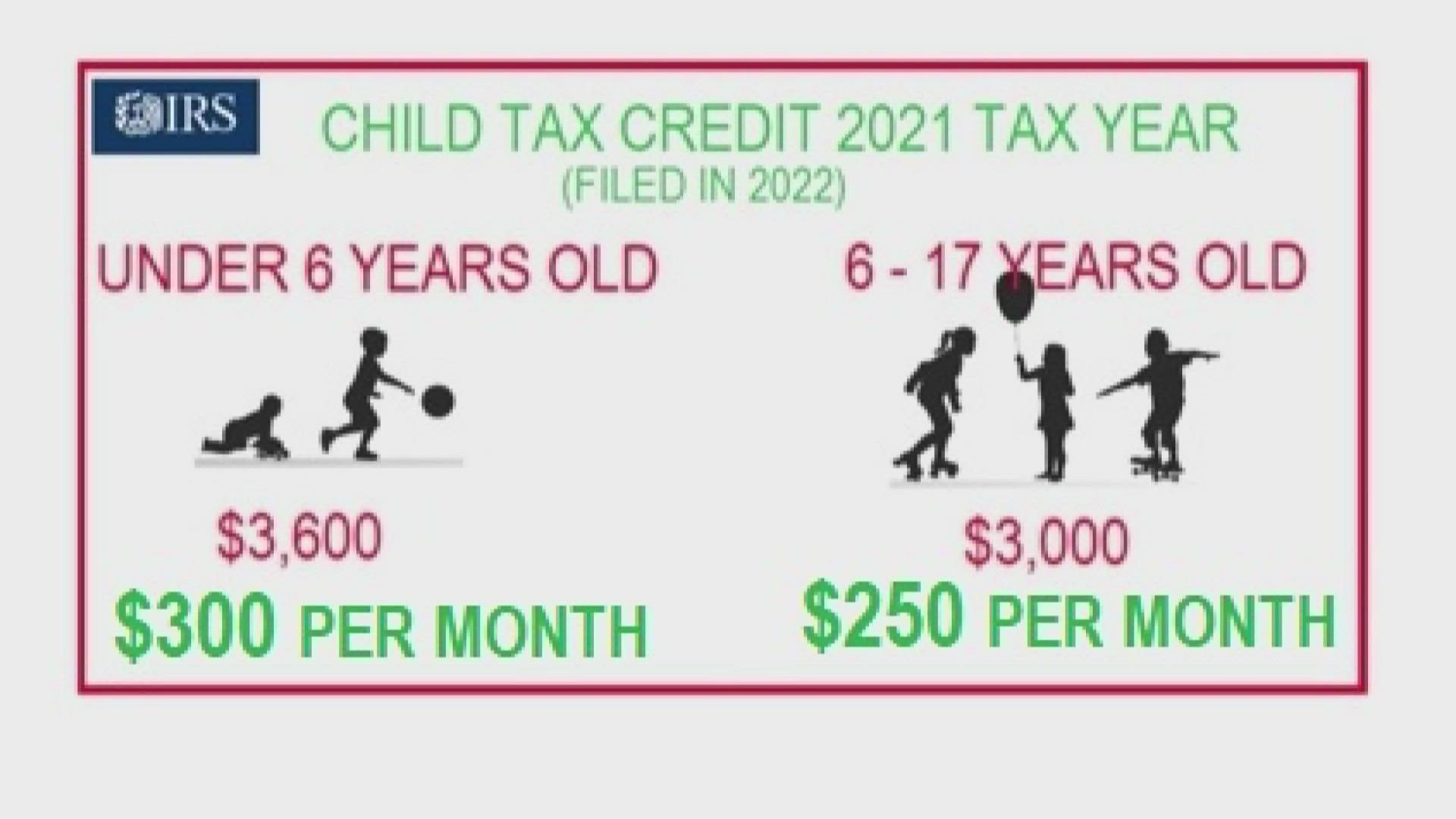

The child tax credit is not new concept. The new policy increased the tax benefit from 2000 a year to a maximum of 3600 a year for children aged five or younger and a maximum of 3000 a year for children.

Permanently Expanded Refundable Tax Credits Will Support An Equitable Economic Recovery National Women S Law Center

They would be eligible to receive 3600 in six monthly installments of 600 between July and December 2021.

. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help. Total Child Tax Credit. Child credit increased to up to 3600 per child.

Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. Competitive 9 and Non-Competitive 4. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Will there be earned income credit in 2022. 1 day agoWhen legislation expanding the child tax credit passed Congress in 2021 it received no GOP support in either the House or Senate. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

Tue Nov 08 2022 LOGIN Subscribe for 1. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. Receives 3600 in 6 monthly installments of 600.

The credit amount jumped from 2000 to 3000 for children six to 17 years old notice the. As part of the American Rescue Act signed into law by President Joe Biden in. They were able to use the credit to meet basic needs with many spending it on food utility bills rent or mortgage payments clothing and education costs.

Ad Browse discover thousands of unique brands. Read customer reviews best sellers. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

2022 Child Tax Rebate. There are two types of Tax Credits. They would receive another 3600 after filing their tax.

For the 2021 tax year. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. The full child tax credit will be available to individuals who earn up to 75000 and couples earning up to 150000 with a complete phased out for individuals earning 95000.

For 2021 and only 2021 the child tax credit was substantially improved. Content updated daily for child tax credit 2022. Ad Looking for child tax credit 2022.

In previous years parents filing taxes claimed a 2000 credit per child. The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

The bill would reinstate a long-lapsed Superfund-related tax on crude oil and imported petroleum products at the rate of 164 centsper barrel which would be indexed to. Increased to 7200 from 4000 thanks to the American Rescue Plan 3600 for each child under age 6. The below information corresponds to the 9 Housing Tax Credit round which is highly competitive and.

1 This credit was. The American Rescue Plan Act of 2021 ARPA temporarily expanded the child tax credit for tax year 2021 from 2000 to 3600 per child under age 6 and 3000 per child up to. See what makes us different.

We dont make judgments or prescribe specific policies.

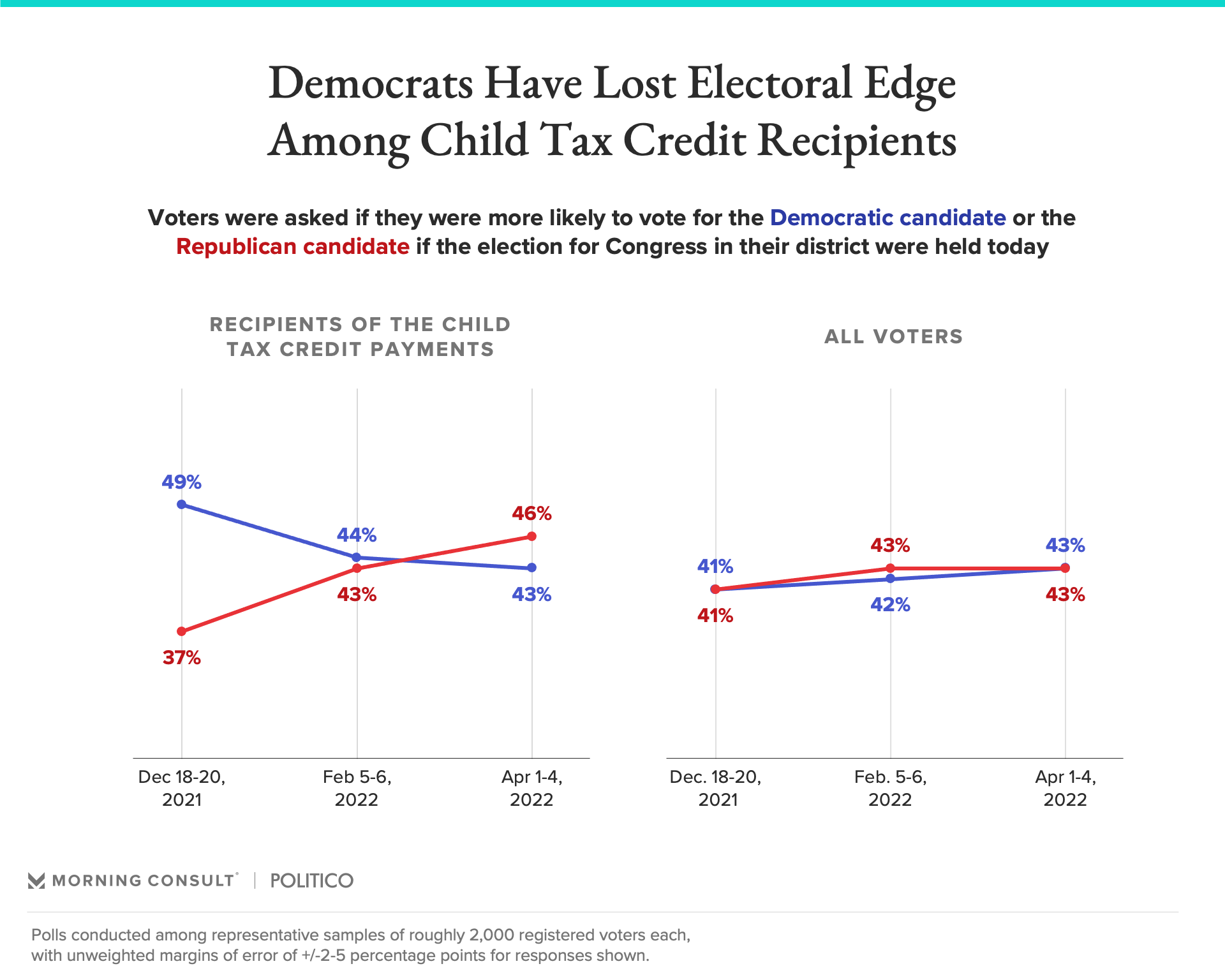

Republicans Favored To Win Senate Among Child Tax Credit Recipients

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How Monthly Child Tax Credit Checks May Be Renewed By Congress

Child Tax Credit 2022 What We Know So Far Kron4

The Expanded Child Tax Credit Kept 4 Million Kids Out Of Poverty Can It Come Back Twitter

Fourth Stimulus Check Cola 2022 Benefits Medicare Child Tax Credit Summary 16 December As Usa

State Earned Income Tax Credits Urban Institute

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

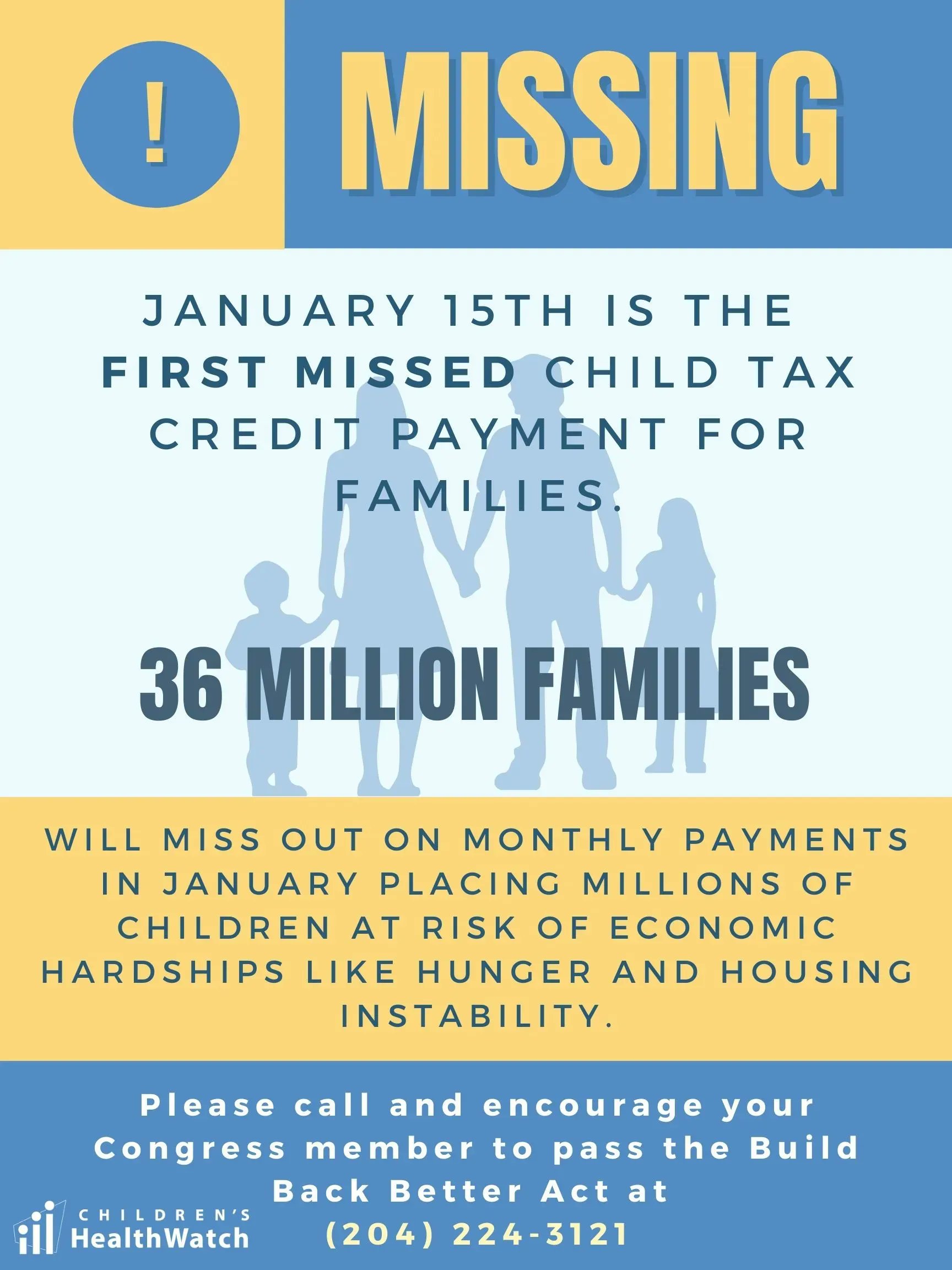

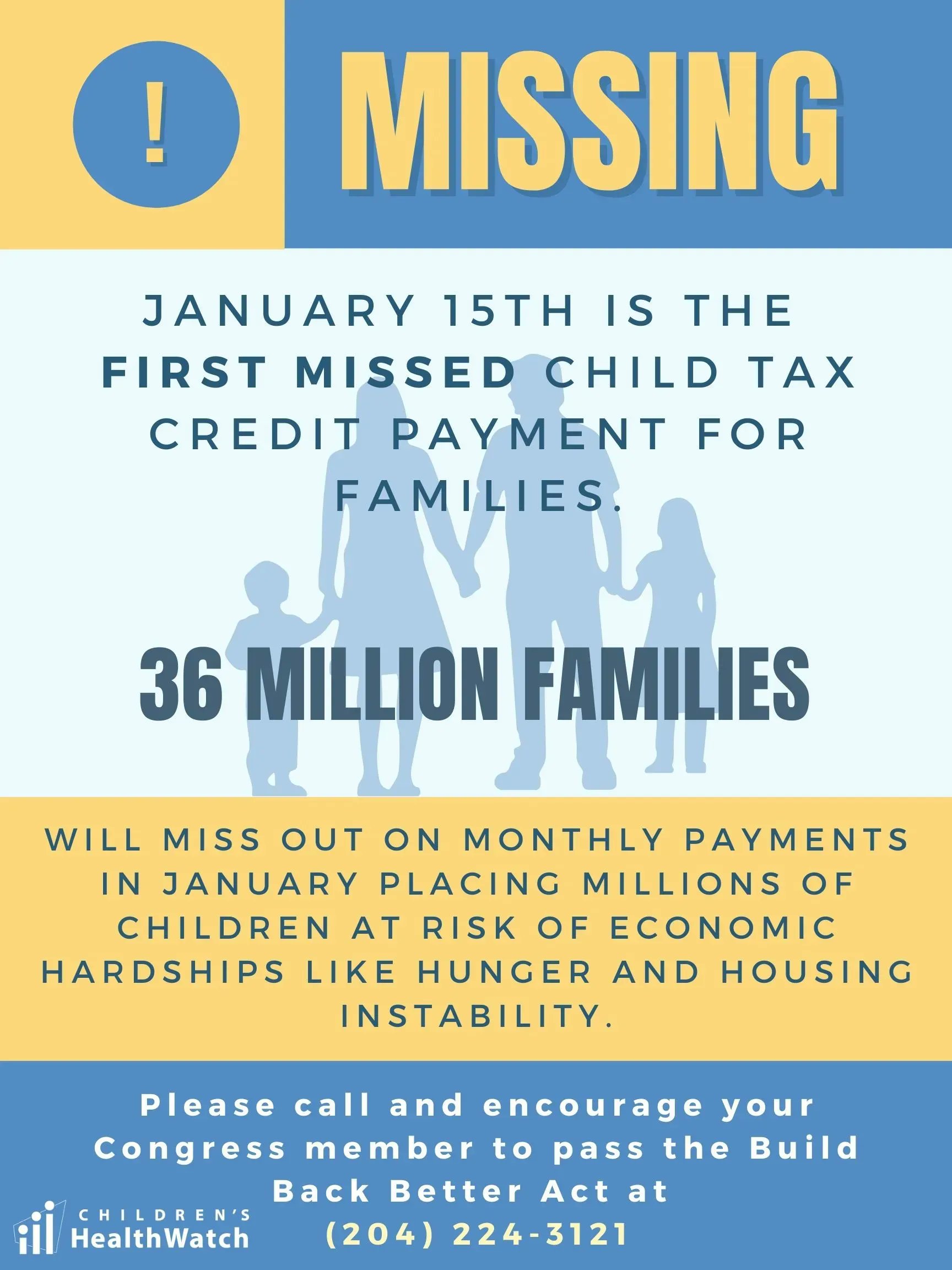

Children S Healthwatch On Twitter Wheresmycheck Congress Must Pass The Buildbackbetter Act And Ensure The Essential Childtaxcredit Continues In 2022 Call Your Senator And Urge Them To Bring Back The Child Tax

Child Tax Credit Extension 2022 When Is The Deadline And Will There Be Payments Next Year The Us Sun

Child Tax Credit Advocates Propose New Way To Expand Monthly Payments For Parents Fast Forward Accounting Solutions

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

/cdn.vox-cdn.com/uploads/chorus_image/image/70269933/GettyImages_1328725400.0.jpg)

Unless Congress Passes The Build Back Better Act The Child Tax Credit Will End In December Vox

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Credit July 2022 Tiktok Search

Child Tax Credit Including How The 2021 Relief Bill Changed It Wsj

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

Faith Leaders Urge Minimum Wage Hike Expanded Child Tax Credit As Congress Nears Recess Maryland Matters

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities