dc income tax withholding calculator

The District of Columbia income tax has six tax brackets with a maximum marginal income tax of 895 as of 2022. Income Tax Calculator 2021.

![]()

Free District Of Columbia Payroll Calculator 2022 Dc Tax Rates Onpay

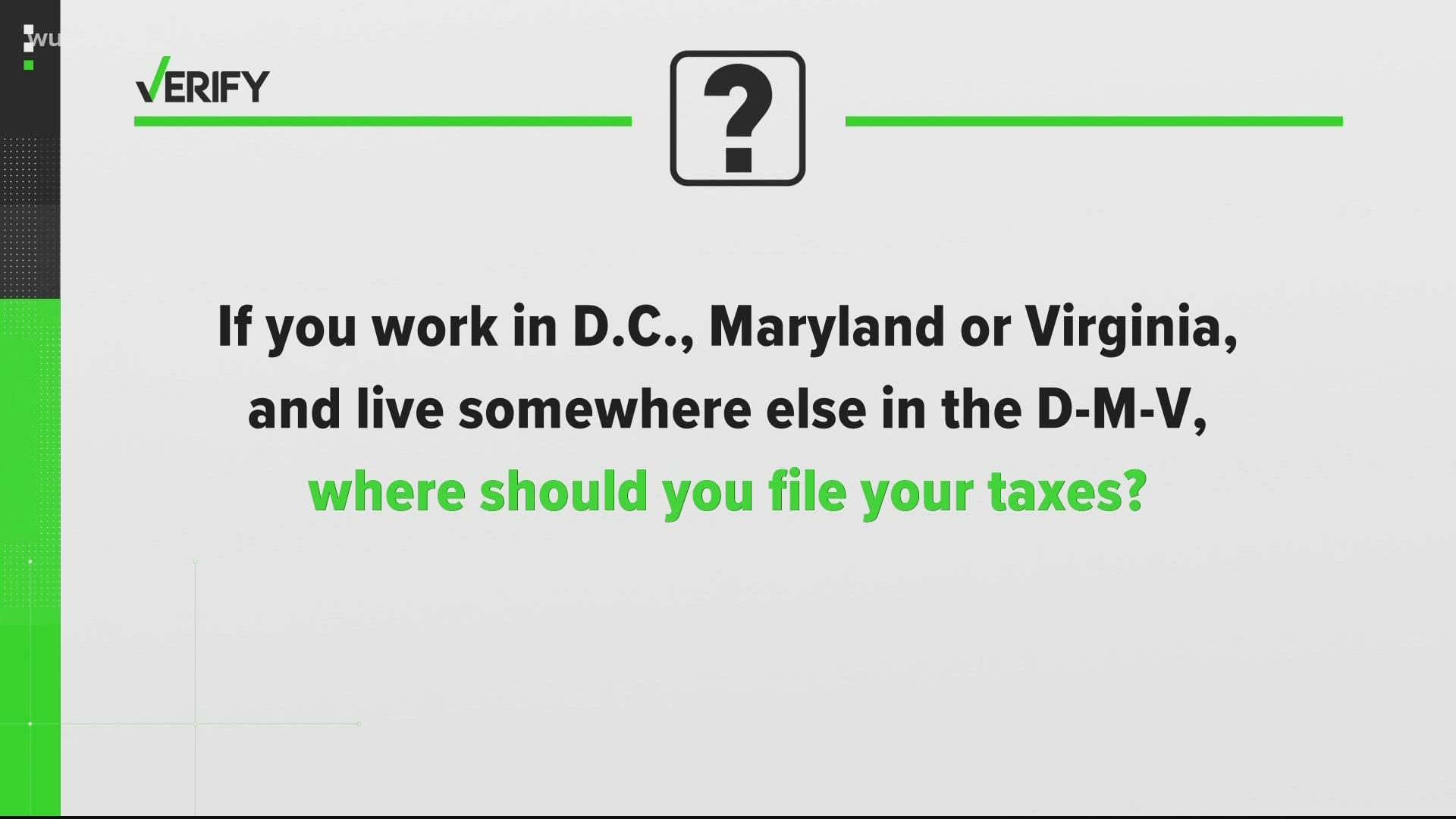

DC residents must pay estimated taxes on any wages they earn outside the District unless their employer pays DC withholding taxes.

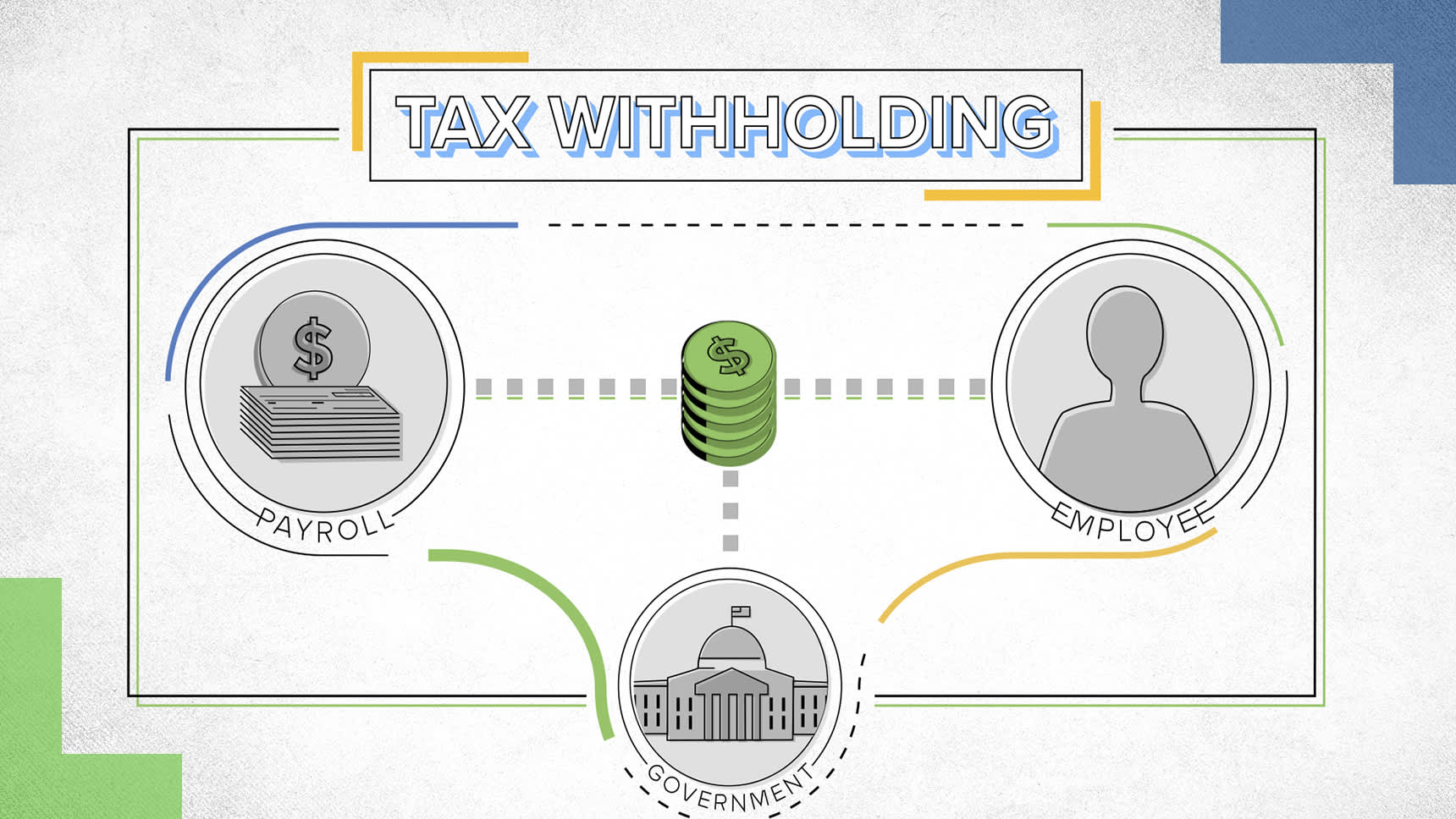

. The tables below reflect withholding amounts in dollars and cents. For help with your withholding you may use the Tax Withholding Estimator. The information you give your employer on Form W4.

Your average tax rate is 1198 and your. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages. Social Security Tax is equal to 62 of your employees taxable wages up to an annual.

Has relatively high income tax rates on a nationwide scale. Check your tax withholding every year especially. Determine the dependent allowance by applying the following guideline and subtract this amount from the.

The local income tax rate in Washington DC is progressive and ranges from 4 to 1075 while federal income tax rates range from 10 to 37 depending on your income. Tax Information Sheet Launch District of Columbia Income Tax Calculator. FICA taxes are made up of two components Social Security Tax and Medicare Tax.

Not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me. Overview of District of Columbia Taxes. Multiply the adjusted gross biweekly wages by 26 to obtain the annual wages.

D-4 Fill-in Employee Withholding Allowance Certificate. If you make 70000 a year living in the region of Washington DC USA you will be taxed 13271. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate.

When you have a major life change. Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the District for 183 or. See withholding on residents nonresidents and expatriates.

It depends on. File with employer when starting new employment or when claimed allowances change. Capital has a progressive income tax rate with six tax brackets.

The amount of income you earn. Subtract the nontaxable biweekly Federal. Follow the link and choose the DC D-4 Employee Withholding Allowance Certificate from the list which you will use to designate your.

DC Tax Withholding Form. For assistance with MyTaxDCgov or account-related questions please contact our e-Services Unit at 202 759-1946 or email e-servicesotrdcgov 815 am to 530 pm Monday. Make your four 4 quarterly.

This Washington DC bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. Withholding Formula District of Columbia Effective 2022. OTR Tax Notice 2022-08 District of Columbia Withholding for Tax Year 2022.

New job or other paid work. Please select the appropriate link from. You can use the Tax Withholding Estimator to estimate.

When to Check Your Withholding.

District Of Columbia Income Tax Calculator Smartasset

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Montgomery County Volunteer Income Tax Assistance Program Vita

The Top Tax Question On Google Will Surprise You Abc News

First Job Here S What You Need To Know About Filing Your Federal Taxes Cnet

The Irs Releases A New Withholding Form Here S What You Need To Know

W 4 Withholding Calculator Tax Form Updates H R Block

Mytax Dc Gov The Official Blog Of The D C Office Of Tax And Revenue

Tax Season 2022 Last Day To File And Where To File In The Dmv Wusa9 Com

Dc Tax Rates Rankings District Of Columbia Taxes Tax Foundation

State Individual Income Tax Rates And Brackets Tax Foundation

Paycheck Taxes Federal State Local Withholding H R Block

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X

Tax Calculator Return Refund Estimator 2022 2023 H R Block

With New Tax Law I R S Urges Taxpayers To Review Withholdings The New York Times

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House